ATE for Employers

Employers who participate in the Alternance Travail-Études (ATE) program play a crucial role in helping students gain real-world experience while developing the next generation of skilled professionals.

Overview

The ATE program links colleges with businesses so students can alternate between academic study and paid, supervised work placements related to their field of study.

Employers become partners in education, hosting students for internships that are part of the students’ official diploma programs (DEC or AEC).

Participating in ATE helps employers meet staffing needs, invest in training future professionals, and strengthen the connection between education and the labor market.

Employer Responsibilities

- Internships must be paid at least at Québec’s minimum wage.

- Placements typically last 8 to 32 weeks, depending on the program.

Work must be directly related to the student’s program of study (e.g., engineering technology, computer science, accounting, etc.).

- Employers designate a workplace supervisor to mentor the student and complete evaluation forms provided by the CEGEP.

- Employers maintain communication with the college’s ATE coordinator throughout the placement.

Interns are considered temporary employees, so the company must comply with labor laws and occupational health and safety standards.

Benefits for Employers

- Recruit motivated students trained in up-to-date, college-level technical programs.

- Evaluate potential future employees before making long-term hiring decisions.

- Access to fresh ideas and perspectives from students learning the latest techniques.

- Strengthen ties with local colleges, contributing to community and workforce development.

- Depending on various circumstances, your company may be able to obtain 24% to 32% in tax credits for expenses related to the internship. For more information, please click here.

Main Criteria to Receive a Tax Credit:

-

- The internship must be at least 140 hours long.

- The intern must be enrolled full-time at a recognized institution.

- The salary paid to the intern must be at least the minimum wage or higher.

- The internship is a maximum of 32 consecutive weeks.

- The company is established in Quebec.

- The company must obtain a certificate of participation in the eligible training internship within a certain period (often within 6 months after the internship) to apply for the credit.

- More information on the tax credit can be found here.

- A wage subsidy offered by the Fédération des chambres de commerce du Québec to support the hiring of interns

- “50% of the gross salary of each eligible intern, for a maximum of $5,000 per student.”

- “70% of the gross salary of each intern from a diverse background or first year, for a maximum of $7,000.” For more information, please click here.

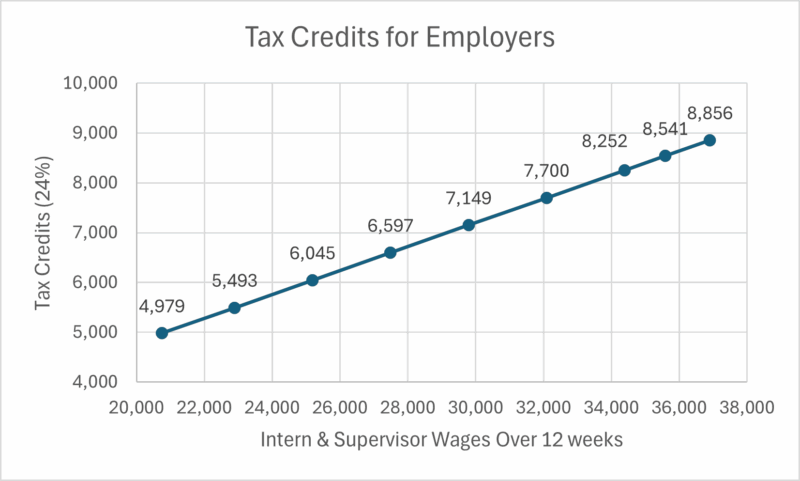

The following table assumes:

- 12-week internship

- 37.5 hours/week

- 24% tax credit rate

- Intern wage increases from $16.10/hr → $30/hr

- Supervisor wage increases proportionally from $30/hr → $52/hr

| Intern wage (X*37.5 h*12 w) |

Supervisor wage (X*37.5 h*12 w) |

Total wages over 12 weeks ($) |

Tax credit (24%) ($) |

|---|---|---|---|

| 7,245 | 13,500 | 20,745 | 4,979 |

| 7,875 | 15,012 | 22,887 | 5,493 |

| 8,662.5 | 16,524 | 25,187 | 6,045 |

| 9,450 | 18,036 | 27,486 | 6,597 |

| 10,237.5 | 19,548 | 29,786 | 7,149 |

| 11,025 | 21,060 | 32,085 | 7,700 |

| 11,812.5 | 22,572 | 34,385 | 8,252 |

| 12,600 | 22,986 | 35,586 | 8,541 |

| 13,500 | 23,400 | 36,900 | 8,856 |

Administrative Details

- Employers collaborate with a CEGEP ATE coordinator to formalize the internship:

- Internship objectives

- Duration and schedule

- Pay and supervision plan

- Employers must complete an evaluation report at the end of the placement.

Submit an Offer

Civil Engineering Technology

Please contact Gloria Colaneri.

Computer Science Technology

You may contact the Computer Science ATE Coordinator for any questions or visit the program page for more information.

Laboratory Technology (Analytical Chemistry)

Please contact Nicolas Duxin.